President Biden Cancels $1.2 Billion in Student Loan Debt

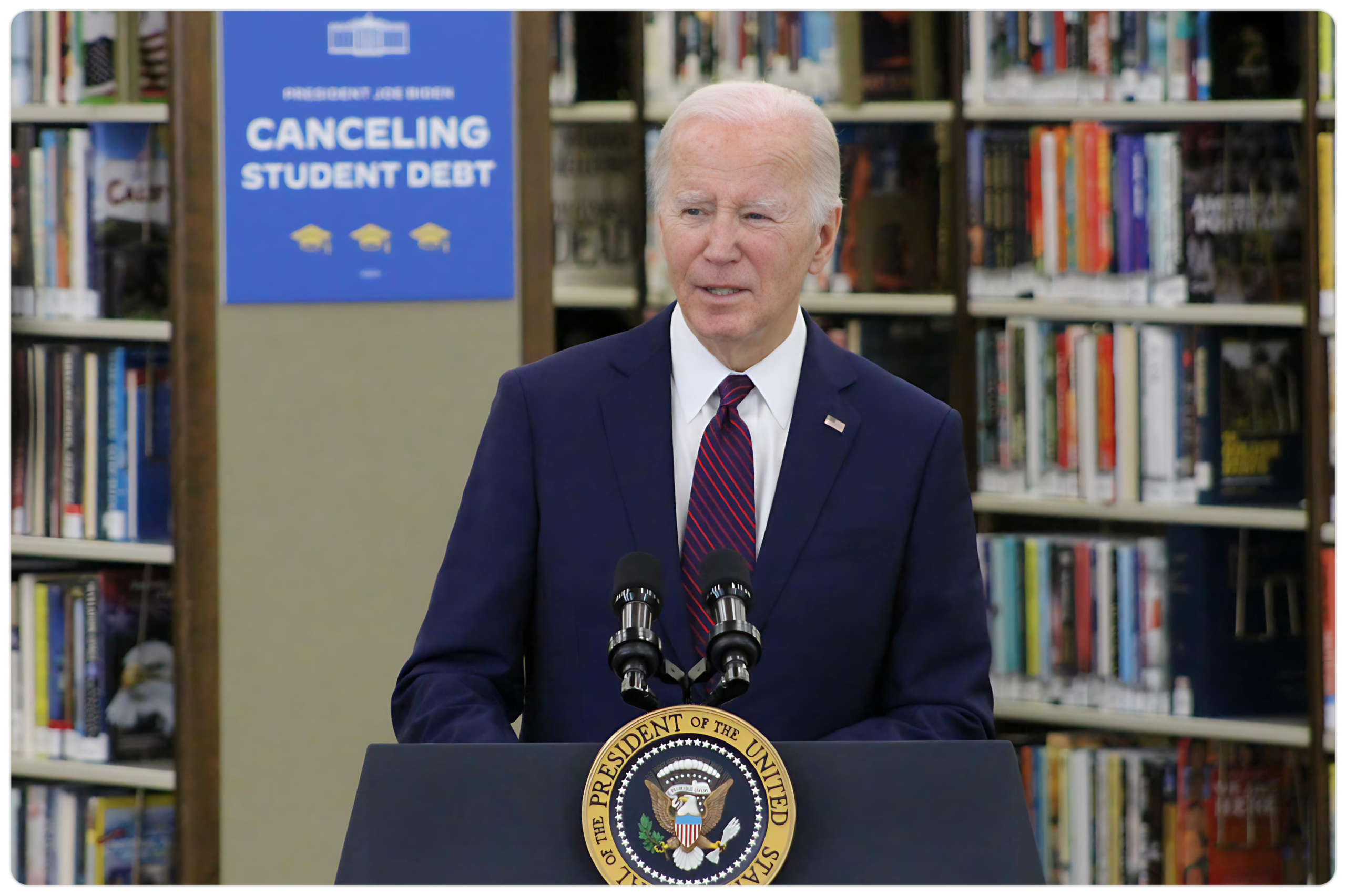

Lady Lila Brown on site at the press conference with President Joe Biden in Los Angeles and other local leaders to announce the cancellation of student loan debt relief.

On February 21st, President Joe Biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the Saving on a Valuable Education (SAVE) repayment plan during a campaign stop touring California which kicked off in Los Angeles. the Biden-Harris Administration first introduced the SAVE plan with the vision that education beyond high school should unlock doors to opportunity, not leave borrowers stranded with debt they cannot afford. The plan ensures the burden of student loans does not hinder the earnings and employment opportunities afforded by a college degree.

From February 20th to February 22nd, the President traveled to Los Angeles, San Francisco, and Los Altos Hills to participate in several political engagements.

The President expressed deep gratitude for being able to make progress as promised to borrowers and repeatedly thanked Culver City Mayor Yasmine Imani-McMorrin for her support in helping to roll out the announcement.

The Biden-Harris Administration has now approved nearly $138 billion in student debt cancellation for almost 3.9 million borrowers through more than two dozen executive actions. The borrowers receiving relief are the first to benefit from a SAVE plan policy that provides debt forgiveness to borrowers who have been in repayment after as little as 10 years and took out $12,000 or less in student loans. Originally planned for July, the Biden-Harris Administration implemented this provision of SAVE and is providing relief to borrowers nearly six months ahead of schedule.

“There were existing programs in the law for fixing and adjusting the programs. We had to change them to make people eligible. And that’s what I’ve done,” said President Biden referring to the Supreme Court’s decision striking down the Administration’s original debt relief plan. “It helps everyone, not just the people whose debt is relieved, but when people in student debt are relieved, they buy homes, they start businesses, they contribute, they engage in the community in ways they weren’t able to before. It actually grows the economy.”

Data from the National Center for Education Statistics prove particularly those from less-advantaged backgrounds, have had to resort to substantial student loans to finance their education. Similarly, college graduates who are the first in their family to go to college are more likely to incur debt to complete their degree than their peers. Over the past 40 years, college tuition has significantly outpaced many families’ incomes.

Very early in his administration, President Biden vowed to fix the student loan system and make sure higher education would be a pathway to the middle class. For many Americans, a college degree has traditionally been the most reliable pathway to the middle class.

“This is what the American dream is all about, and this is exactly what the President is advocating for. When people are financially insecure, they are unable to feel when the economy is good. Our economy is stronger than ever, but that is hard to notice when you’re in the quicksand of student loan debt,” said Congresswoman Sydney Kamlager-Dove (CA-37) who provided remarks during the press conference that included Senator Alex Padilla (D-CA), Los Angeles Mayor Karen Bass, Mayor McMorrin, Los Angeles County Supervisor Holly J. Mitchell, Los Angeles County Supervisor Lindsey Horvath, and other elected officials in attendance to announce the student debt relief. “Student loan debt disproportionately hurts people of color. Black college graduates have, on average, $25,000 more in student debt than white college graduates. This is evidence of something we all already knew: that the cost of success is higher if you’re Black. Combating this disparity must be part of the conversations we have around student debt, just like it is around wealth creation. And President Biden gets it.”

The Biden-Harris Administration introduced the Saving on a Valuable Education (SAVE) plan in August 2023. This new income-driven repayment (IDR) plan, like its predecessor, is voluntary and bases monthly student loan payments on the borrower’s earnings. However, the new formula includes adjustments such as (but not limited to) shielding more income from being used to calculate student loan payments and waiving unpaid interest at the end of each month to lower monthly payments. This allows more flexibility compared to previous repayment plans for those who may want to have more cash on hand earlier in their careers: a time when income levels are often lower and individuals tend to be more financially unstable.

As the full SAVE regulations go into effect on July 1, 2024, the Department of Education has implemented three key benefits starting with the amount of income protected from payments on the SAVE plan which has risen to 225% of the Federal poverty guidelines (FPL). Next, the Department has stopped charging any monthly interest not covered by the borrower’s payment; and finally, married borrowers who file their taxes separately are no longer required to include their spouse’s income in their payment calculation for SAVE. Other provisions, such as payments on undergraduate loans being cut from 10% to 5% of incomes above 225% of FPL, will go into effect during this time.

“Skyrocketing student loan debt doesn’t just prohibit young people from getting the education they need and deserve, student loan debt prevents young people from buying a car, buying a house, and starting a family, said Mayor Bass who hosted President Biden at CJ’s Cafe in Baldwin Hills en route to the Julian Dixon Library in Culver City ahead of the announcement.

“Addressing student loan debt should be thought of as a jobs initiative, she continued. “This should be thought of as a housing initiative. This should be thought of as an economic motivator for young people throughout the country. Student loan debt cripples our workforce – especially when it comes to addressing homelessness. We need more social workers, more mental health specialists, and more service providers. By tackling student loan debt, young people will be able to pursue these professions that save lives – that is what addressing this issue means.

During his remarks, President Biden thanked Mayor Bass for her partnership and friendship.

While introducing the President, Dr. Jessica Saint Paul, a Physician Assistant, and public health practitioner shared her story supporting underserved communities throughout her career and spoke on the importance of receiving student debt relief. Her loans ballooned from $90,000 to $145,000 even though she was making monthly payments. Having lived in the U.S. as a Haitian immigrant, Dr. Saint Paul said the inability to repay back loans delayed her plans to start a family but since her debt had been forgiven, she was able to follow through on her dreams and is now the proud mother to a baby daughter. She currently works as an Adjunct Professor for the Los Angeles Community College District developing and implementing Wellness Centers for students throughout the L.A. Unified School District.

The White House Council of Economic Advisers issued a brief highlighting how low and middle-income borrowers enrolled in SAVE could see significant saving in terms of interest saved over time and principal forgiven as a result of SAVE’s early forgiveness provisions.

Historic steps have been taken to improve the student loan program and make higher education more affordable for more Americans achieving the largest increases in Pell Grants in over a decade to help families who earn less than $60,000 a year achieve their higher-education goals. This also fixes the Public Service Loan Forgiveness program so borrowers who go into public service get the debt relief they’re entitled to under the law. Before President Biden took office, only 7,000 people ever received debt relief through PSLF. After fixing the program, the Biden-Harris Administration has now cancelled student loan debt for nearly 800,000 public service workers. Moreover, the plan cancels student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of administrative failures with Income-Driven Repayment Plans. Finally, these actions will hold colleges accountable for leaving students with unaffordable debts.

Recently, the Department of Education released proposed regulatory text to cancel student debt for borrowers who are experiencing hardship paying back their student loans, and late last year released proposals to cancel student debt for borrowers who: owe more than they borrowed, first entered repayment 20 or 25 years ago, attended low quality programs, and who would be eligible for loan forgiveness through income-driven repayment programs like SAVE but have not applied. Next, the Department of Education begin outreach directly to borrowers who are eligible for early relief but not currently enrolled in the SAVE Plan to encourage them to enroll as soon as possible.

“I’m proud to have been able to give borrowers like so many of you the relief you earned. I promise you, I’m never going to stop fighting for hardworking American families. If you qualify, you’ll be hearing from me shortly,” the President concluded. “It’s about your dignity. It’s about opportunity. We’re giving people a fighting chance to make it. We have the most advanced economy of any major nation in the world. We have a lot more to do. But with the help of all new college graduates having paid off your student loans now, I’m confident we’re going to get it all done.”